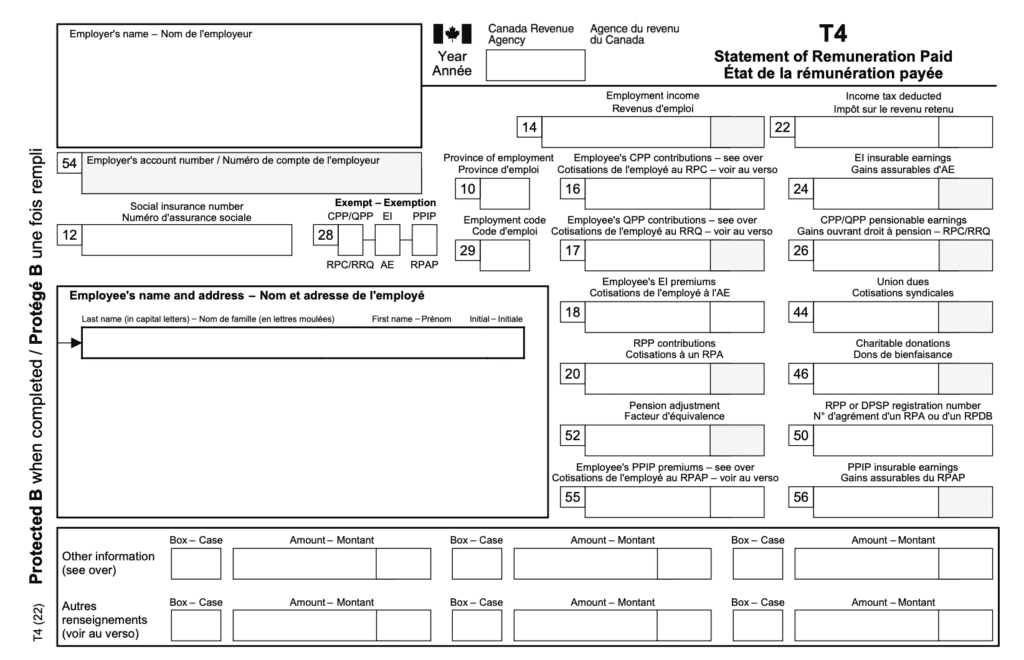

What is T4 Slip? A T4 slip, also known as a Statement of Remuneration Paid, is a form that is issued by an employer to an employee to report employment income and deductions for a specific tax year. The T4 slip shows the total amount of salary, wages, and other taxable benefits that the employee received during the year, as well as any deductions that were made from their pay, such as income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums.

Employers are required to issue T4 slips to their employees by the end of February for the previous tax year. Employees will need to report the income and deductions shown on their T4 slips when they file their tax returns.

The T4 slip is one of several types of slips that are used to report income and deductions for tax purposes. Other common types of slips include the T3 slip, which is used to report income from investments, and the T5 slip, which is used to report income from other sources, such as dividends and interest.

Why T4 slips are important?

T4 slips are important because they provide a record of the employment income and deductions that an employee has received for a specific tax year. Employees will need to report the income and deductions shown on their T4 slips when they file their tax returns, and the information on the slips is used by the Canada Revenue Agency (CRA) to calculate the tax that is owed by the employee.

In addition to being used for tax purposes, T4 slips are also used for other purposes, such as to apply for government benefits, to verify employment income for a mortgage or loan application, or to verify employment income for a divorce or separation settlement.

It’s important to keep track of your T4 slips and to report the income and deductions shown on the slips accurately on your tax return. Failing to report all of your income or claiming incorrect deductions can result in penalties and interest charges, and can also affect your eligibility for government benefits and other programs.

If you have any questions about T4 slips or how to report income and deductions on your tax return, you can contact the CRA for assistance.

If you need professional help contact us